Give quality employees what they’re looking for— health coverage.

Offering health coverage as part of your compensation package helps make your business more attractive to potential employees. Let us help you find a plan that’s right for your specific business needs.

Already have an account? Login

Need a local broker? Find a broker

Finding benefits with the BusinessPlus platform

Busy CT business owners can now utilize our BusinessPlus platform for a simplified experience managing health benefits, including an ICHRA. ICHRA provides business owners an alternative to traditional group health while still providing benefits to their employees and business. See some of the benefits for yourself:

We’ll help make your business more attractive.

Small businesses that provide health coverage to their employees have an easier time attracting and retaining quality talent. Together, we’ll help you understand your options, find a health coverage solution that’s right for your business, and even help you see if you qualify for any tax credits.

“How does ICHRA differ from a traditional HRA?”

• Traditional HRAs are often integrated with group health plans, while ICHRA is paired with

individual market insurance.

• ICHRA provides more flexibility in defining eligibility classes and employer contribution levels.

See if you are eligible for tax credits (financial help)

We can help you see if your small business qualifies for tax credits — in some cases up to 50% of your contributions toward your employees premiums (monthly payments), or up to 35% for non-profits

“Is there a specific enrollment date or timeframe?”

No. Group insurance is not tied to an annual enrollment date and is instead based on a rolling date, so employers can start any time.

![]() Franco Barrero | Contact me

Franco Barrero | Contact me

All health plans offered through Access Health CT Small Business provide coverage for ten Essential Health Benefits.

Prescription drug coverage

Prescription drug coverage

Key preventive and wellness services and chronic disease management

Key preventive and wellness services and chronic disease management

Pediatric (children’s health and well-child care) services, including dental and vision care

Pediatric (children’s health and well-child care) services, including dental and vision care

Maternity and newborn care

Maternity and newborn care

Outpatient services (ambulatory care)

Outpatient services (ambulatory care)

Laboratory services and tests

Laboratory services and tests

Emergency services

Emergency services

In-hospital care (hospitalization)

In-hospital care (hospitalization)

Mental health and substance abuse services, including behavioral health treatment

Mental health and substance abuse services, including behavioral health treatment

Rehabilitative and habilitative services and devices

Rehabilitative and habilitative services and devices

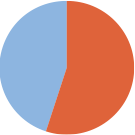

of private businesses in the US with fewer than 50 employees offer medical benefits to their employees1.

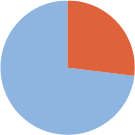

of Connecticut businesses with fewer than 50 employees offer health insurance of any kind to employees2.

Want to know what plans we offer?

For 2026 Access Health CT Small Business offers four (4) metal tiers of coverage.

Anthem Platinum Pathway CT PPO

2026

| Benefit Year: | For Plan Year 2026 |

| Referrals: | Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $25 Copayment per visit |

| Specialist Office Visit | |

| Prescription Drugs | |

| Mail Order Drug | |

| Inpatient Hospital | |

| Emergency Room | |

| Walk-in Urgent Care | |

| Ambulance | |

| Outpatient Surgery | |

| Laboratory Service | |

| Outpatient Diagnostic Tests | |

| Outpatient Diagnostic Imaging | |

| Outpatient Mental Health | |

| Durable Medical Equipment | |

| Individual Deductible | |

| Family Deductible | |

| Out-of-Pocket Maximum | |

| Family Out-of-Pocket Maximum |

Anthem Gold Pathway CT PPO

2026

| Benefit Year: | For Plan Year 2026 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $30 Copayment per visit |

| Specialist Office Visit | $60 Copayment per visit |

| Prescription Drugs | Tier 1: No Cost; Tier 2: $10 Copay; Tier 3: $60 Copay; Tier 4: 30% up to $500; Tier 5: 30% up to $1000 |

| Mail Order Drug | Tier 1: No Cost; Tier 2: $25 Copay; Tier 3: $180 Copay; Tier 4: 30% up to $1500; Tier 5: 30% up to $1000 |

| Inpatient Hospital | No Cost after Plan Deductible is met |

| Emergency Room | 20% Coinsurance after Plan Deductible is met |

| Walk-in Urgent Care | $30 Copayment per visit at a Walk-In Center; $100 Copayment per visit at an Urgent Care Facility (Urgent Care Center) |

| Ambulance | No Cost |

| Outpatient Surgery | $300 Copayment per visit at a Surgical Center; No Cost-Share after Deductible is met at an Outpatient Hospital Facility |

| Laboratory Service | No Cost-Share at Site-of-Service Providers No Cost- Share after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No cost at site-of-service providers; No cost after deductible at outpatient hospital facility |

| Outpatient Diagnostic Imaging | $75 copay to $375 max at site-of-service providers; No cost after deductible is met at outpatient hospital facility |

| Outpatient Mental Health | No Cost-Share after deductible is met |

| Durable Medical Equipment | 50% Coinsurance after deductible is met |

| Individual Deductible | $2,500 |

| Family Deductible | $5,000 |

| Out-of-Pocket Maximum | $5,000 |

| Family Out-of-Pocket Maximum | $10,000 |

Anthem Silver Pathway CT PPO

2026

| Benefit Year: | For Plan Year 2026 |

| Referrals: | Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $50 Copayment per visit |

| Specialist Office Visit | $100 Copayment per visit |

| Prescription Drugs | Tier 1: $0 Copayment; Tier 2: $10 Copayment; Tier 3: $60 Copay; Tier 4: 30% Coinsurance up to $500; Tier 5: 30% Coinsurance up to $1,000 |

| Mail Order Drug | Tier 1: $0 Copayment; Tier 2: $25 Copayment; Tier 3: $180; Tier 4: 30% Coinsurance up to $1,500; Tier 5: 30% Coinsurance up to $1,000 |

| Inpatient Hospital | 25% Coinsurance after Plan Deductible is met |

| Emergency Room | 25% Coinsurance after Plan Deductible is met |

| Walk-in Urgent Care | $50 Copayment per visit at a Walk-In Center; $100 Copayment per visit at an Urgent Care Facility (Urgent Care Center) |

| Ambulance | 25% Coinsurance |

| Outpatient Surgery | $500 Copayment per visit at a Surgical Center; 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Laboratory Service | No Cost-Share at Site-of-Service Providers 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No Cost-Share at Site-of-Service Providers; 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Imaging | $75 Copayment per service up to an annual maximum of $375 for MRI, MRA, CAT, CTA, PET and SPECT scans at Site-of-Service Providers; 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Mental Health | 25% Coinsurance after Deductible is met |

| Durable Medical Equipment | 50% Coinsurance after Deductible is met |

| Individual Deductible | $5,500 |

| Family Deductible | $10,000 |

| Out-of-Pocket Maximum | $9,000 |

| Family Out-of-Pocket Maximum | $18,000 |

Anthem Silver Pathway CT PPO w/HSA

2026

| Benefit Year: | For Plan Year 2026 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $50 Copayment per visit after Plan Deductible is met |

| Specialist Office Visit | $100 Copayment per visit after Plan Deductible is met |

| Prescription Drugs | Tier 1: $0 Copay; Tier 2: $10 Copay; Tier 3: $60 Copay; Tier 4: 30% Coinsurance after Deductible is met; Tier 5: 30% Coinsurance after Deductible is met |

| Mail Order Drug | Tier 1: $0 Copay; Tier 2: $25 Copay; Tier 3: $180 Copay; Tier 4: 30% Coinsurance after Deductible is met; Tier 5: 30% after Deductible is met |

| Inpatient Hospital | 20% Coinsurance after Plan Deductible is met |

| Emergency Room | 20% Coinsurance after Plan Deductible is met |

| Walk-in Urgent Care | Walk-In: $40 Copayment per visit after Plan Deductible Urgent Care: $100 Copayment per visit after Plan Deductible |

| Ambulance | 20% Coinsurance after Plan Deductible is met |

| Outpatient Surgery | $400 Copayment per visit after Deductible is met at a Surgery Center; 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Laboratory Service | No Cost-Share after Deductible is met at Site-of-Service Providers 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | $75 Copayment per service after Deductible is met at Site-of-Service Providers; 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Imaging | $75 Copayment per service up to an annual maximum of $375 at Site-of-Service Providers; 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Mental Health | 20% Coinsurance after Deductible is met |

| Durable Medical Equipment | 50% Coinsurance after Deductible is met |

| Individual Deductible | $3,000 |

| Family Deductible | $6,000 |

| Out-of-Pocket Maximum | $7,000 |

| Family Out-of-Pocket Maximum | $14,000 |

Anthem Bronze Pathway CT PPO

2026

| Benefit Year: | For Plan Year 2026 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | No Cost after Plan Deductible is met |

| Specialist Office Visit | No Cost after Plan Deductible is met |

| Prescription Drugs | No Cost after Plan Deductible is met |

| Mail Order Drug | No Cost after Plan Deductible is met |

| Inpatient Hospital | No Cost after Plan Deductible is met |

| Emergency Room | No Cost after Plan Deductible is met |

| Walk-in Urgent Care | No Cost after Plan Deductible is met |

| Ambulance | No Cost after Plan Deductible is met |

| Outpatient Surgery | No Cost after Plan Deductible is met |

| Laboratory Service | No Cost-Share after Plan Deductible is met at an Independent Lab No Cost after Plan Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No Cost after Plan Deductible is met |

| Outpatient Diagnostic Imaging | No Cost after Plan Deductible is met |

| Outpatient Mental Health | No Cost after Plan Deductible is met |

| Durable Medical Equipment | No Cost after Plan Deductible is met |

| Individual Deductible | $9,000 |

| Family Deductible | $18,000 |

| Out-of-Pocket Maximum | $9,000 |

| Family Out-of-Pocket Maximum | $18,000 |

Anthem Bronze Pathway CT PPO w/HSA

2026

| Benefit Year: | For Plan Year 2026 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | No Cost after Plan Deductible is met |

| Specialist Office Visit | No Cost after Plan Deductible is met |

| Prescription Drugs | No Cost-Share after Deductible is met |

| Mail Order Drug | No Cost-Share after Deductible is met |

| Inpatient Hospital | No Cost after Plan Deductible is met |

| Emergency Room | No Cost after Plan Deductible is met |

| Walk-in Urgent Care | No Cost after Plan Deductible is met |

| Ambulance | No Cost after Plan Deductible is met |

| Outpatient Surgery | No Cost after Plan Deductible is met |

| Laboratory Service | No Cost-Share after Plan Deductible is met at an Independent Lab No Cost after Plan Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No Cost after Plan Deductible is met |

| Outpatient Diagnostic Imaging | No Cost after Plan Deductible is met |

| Outpatient Mental Health | No Cost after Plan Deductible is met |

| Durable Medical Equipment | No Cost after Plan Deductible is met |

| Individual Deductible | $7,450 |

| Family Deductible | $14,900 |

| Out-of-Pocket Maximum | $7,450 |

| Family Out-of-Pocket Maximum | $14,900 |

Anthem Platinum Pathway CT PPO

2025

| Benefit Year: | For Plan Year 2025 |

| Referrals: | Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $20 Copayment per visit |

| Specialist Office Visit | |

| Prescription Drugs | |

| Mail Order Drug | |

| Inpatient Hospital | |

| Emergency Room | |

| Walk-in Urgent Care | |

| Ambulance | |

| Outpatient Surgery | |

| Laboratory Service | |

| Outpatient Diagnostic Tests | |

| Outpatient Diagnostic Imaging | |

| Outpatient Mental Health | |

| Durable Medical Equipment | |

| Individual Deductible | |

| Family Deductible | |

| Out-of-Pocket Maximum | |

| Family Out-of-Pocket Maximum |

Anthem Gold Pathway CT PPO

2025

| Benefit Year: | For Plan Year 2025 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $25 Copayment per visit |

| Specialist Office Visit | $60 Copayment per visit |

| Prescription Drugs | Tier 1: No Cost; Tier 2: $10 Copay; Tier 3: $60 Copay; Tier 4: 30% up to $500; Tier 5: 30% up to $1000 |

| Mail Order Drug | Tier 1: No Cost; Tier 2: $25 Copay; Tier 3: $180 Copay; Tier 4: 30% up to $1500; Tier 5: 30% up to $1000 |

| Inpatient Hospital | No Cost after Plan Deductible is met |

| Emergency Room | 20% Coinsurance after Plan Deductible is met |

| Walk-in Urgent Care | $25 Copayment per visit at a Walk-In Center; $100 Copayment per visit at an Urgent Care Facility (Urgent Care Center) |

| Ambulance | No Cost |

| Outpatient Surgery | $300 Copayment per visit at a Surgical Center; No Cost-Share after Deductible is met at an Outpatient Hospital Facility |

| Laboratory Service | No Cost-Share at Site-of-Service Providers No Cost- Share after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No cost at site-of-service providers; No cost after deductible at outpatient hospital facility |

| Outpatient Diagnostic Imaging | $75 copay to $375 max at site-of-service providers; No cost after deductible is met at outpatient hospital facility |

| Outpatient Mental Health | No Cost-Share after deductible is met |

| Durable Medical Equipment | 50% Coinsurance after deductible is met |

| Individual Deductible | $2,500 |

| Family Deductible | $5,000 |

| Out-of-Pocket Maximum | $5,000 |

| Family Out-of-Pocket Maximum | $10,000 |

Anthem Silver Pathway CT PPO

2025

| Benefit Year: | For Plan Year 2025 |

| Referrals: | Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $50 Copayment per visit |

| Specialist Office Visit | $100 Copayment per visit |

| Prescription Drugs | Tier 1: $0 Copayment; Tier 2: $10 Copayment; Tier 3: $60 Copay; Tier 4: 30% Coinsurance up to $500; Tier 5: 30% Coinsurance up to $1,000 |

| Mail Order Drug | Tier 1: $0 Copayment; Tier 2: $25 Copayment; Tier 3: $180; Tier 4: 30% Coinsurance up to $1,500; Tier 5: 30% Coinsurance up to $1,000 |

| Inpatient Hospital | 25% Coinsurance after Plan Deductible is met |

| Emergency Room | 25% Coinsurance after Plan Deductible is met |

| Walk-in Urgent Care | $50 Copayment per visit at a Walk-In Center; $100 Copayment per visit at an Urgent Care Facility (Urgent Care Center) |

| Ambulance | 25% Coinsurance |

| Outpatient Surgery | $500 Copayment per visit at a Surgical Center; 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Laboratory Service | No Cost-Share at Site-of-Service Providers 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No Cost-Share at Site-of-Service Providers; 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Imaging | $75 Copayment per service up to an annual maximum of $375 for MRI, MRA, CAT, CTA, PET and SPECT scans at Site-of-Service Providers; 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Mental Health | 25% Coinsurance after Deductible is met |

| Durable Medical Equipment | 50% Coinsurance after Deductible is met |

| Individual Deductible | $5,500 |

| Family Deductible | $10,000 |

| Out-of-Pocket Maximum | $9,000 |

| Family Out-of-Pocket Maximum | $18,000 |

Anthem Silver Pathway CT PPO w/HSA

2025

| Benefit Year: | For Plan Year 2025 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $50 Copayment per visit after Plan Deductible is met |

| Specialist Office Visit | $100 Copayment per visit after Plan Deductible is met |

| Prescription Drugs | Tier 1: $0 Copay; Tier 2: $10 Copay; Tier 3: $60 Copay; Tier 4: 30% Coinsurance after Deductible is met; Tier 5: 30% Coinsurance after Deductible is met |

| Mail Order Drug | Tier 1: $0 Copay; Tier 2: $25 Copay; Tier 3: $180 Copay; Tier 4: 30% Coinsurance after Deductible is met; Tier 5: 30% after Deductible is met |

| Inpatient Hospital | 20% Coinsurance after Plan Deductible is met |

| Emergency Room | 20% Coinsurance after Plan Deductible is met |

| Walk-in Urgent Care | Walk-In: $40 Copayment per visit after Plan Deductible Urgent Care: $100 Copayment per visit after Plan Deductible |

| Ambulance | 20% Coinsurance after Plan Deductible is met |

| Outpatient Surgery | $400 Copayment per visit after Deductible is met at a Surgery Center; 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Laboratory Service | No Cost-Share after Deductible is met at Site-of-Service Providers 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | $75 Copayment per service after Deductible is met at Site-of-Service Providers; 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Imaging | $75 Copayment per service up to an annual maximum of $375 at Site-of-Service Providers; 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Mental Health | 20% Coinsurance after Deductible is met |

| Durable Medical Equipment | 50% Coinsurance after Deductible is met |

| Individual Deductible | $3,000 |

| Family Deductible | $6,000 |

| Out-of-Pocket Maximum | $7,000 |

| Family Out-of-Pocket Maximum | $14,000 |

Anthem Bronze Pathway CT PPO

2025

| Benefit Year: | For Plan Year 2025 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | No Cost after Plan Deductible is met |

| Specialist Office Visit | No Cost after Plan Deductible is met |

| Prescription Drugs | No Cost after Plan Deductible is met |

| Mail Order Drug | No Cost after Plan Deductible is met |

| Inpatient Hospital | No Cost after Plan Deductible is met |

| Emergency Room | No Cost after Plan Deductible is met |

| Walk-in Urgent Care | No Cost after Plan Deductible is met |

| Ambulance | No Cost after Plan Deductible is met |

| Outpatient Surgery | No Cost after Plan Deductible is met |

| Laboratory Service | No Cost-Share after Plan Deductible is met at an Independent Lab No Cost after Plan Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No Cost after Plan Deductible is met |

| Outpatient Diagnostic Imaging | No Cost after Plan Deductible is met |

| Outpatient Mental Health | No Cost after Plan Deductible is met |

| Durable Medical Equipment | No Cost after Plan Deductible is met |

| Individual Deductible | $9,000 |

| Family Deductible | $18,000 |

| Out-of-Pocket Maximum | $9,000 |

| Family Out-of-Pocket Maximum | $18,000 |

Anthem Bronze Pathway CT PPO w/HSA

2025

| Benefit Year: | For Plan Year 2025 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | No Cost after Plan Deductible is met |

| Specialist Office Visit | No Cost after Plan Deductible is met |

| Prescription Drugs | No Cost-Share after Deductible is met |

| Mail Order Drug | No Cost-Share after Deductible is met |

| Inpatient Hospital | No Cost after Plan Deductible is met |

| Emergency Room | No Cost after Plan Deductible is met |

| Walk-in Urgent Care | No Cost after Plan Deductible is met |

| Ambulance | No Cost after Plan Deductible is met |

| Outpatient Surgery | No Cost after Plan Deductible is met |

| Laboratory Service | No Cost-Share after Plan Deductible is met at an Independent Lab No Cost after Plan Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No Cost after Plan Deductible is met |

| Outpatient Diagnostic Imaging | No Cost after Plan Deductible is met |

| Outpatient Mental Health | No Cost after Plan Deductible is met |

| Durable Medical Equipment | No Cost after Plan Deductible is met |

| Individual Deductible | $7,450 |

| Family Deductible | $14,900 |

| Out-of-Pocket Maximum | $7,450 |

| Family Out-of-Pocket Maximum | $14,900 |

Anthem Gold Pathway CT PPO

2024

| Benefit Year: | For Plan Year 2024 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $25 Copayment per visit |

| Specialist Office Visit | $60 Copayment per visit |

| Prescription Drugs | Tier 1: No Cost; Tier 2: $10 Copay; Tier 3: $60 Copay; Tier 4: 30% up to $500; Tier 5: 30% up to $1000 |

| Mail Order Drug | Tier 1: No Cost; Tier 2: $25 Copay; Tier 3: $180 Copay; Tier 4: 30% up to $1500; Tier 5: 30% up to $1000 |

| Inpatient Hospital | No Cost after Plan Deductible is met |

| Emergency Room | 20% Coinsurance after Plan Deductible is met |

| Walk-in Urgent Care | $25 Copayment per visit at a Walk-In Center; $100 Copayment per visit at an Urgent Care Facility (Urgent Care Center) |

| Ambulance | No Cost |

| Outpatient Surgery | $300 Copayment per visit at a Surgical Center; No Cost-Share after Deductible is met at an Outpatient Hospital Facility |

| Laboratory Service | No Cost-Share at Site-of-Service Providers No Cost- Share after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No cost at site-of-service providers; No cost after deductible at outpatient hospital facility |

| Outpatient Diagnostic Imaging | $75 copay to $375 max at site-of-service providers; No cost after deductible is met at outpatient hospital facility |

| Outpatient Mental Health | No Cost-Share after deductible is met |

| Durable Medical Equipment | 50% Coinsurance after deductible is met |

| Individual Deductible | $2,500 |

| Family Deductible | $5,000 |

| Out-of-Pocket Maximum | $5,000 |

| Family Out-of-Pocket Maximum | $10,000 |

Anthem Silver Pathway CT PPO

2024

| Benefit Year: | For Plan Year 2024 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $50 Copayment per visit |

| Specialist Office Visit | $100 Copayment per visit |

| Prescription Drugs | Tier 1: $0 Copayment; Tier 2: $10 Copayment; Tier 3: $60 Copay; Tier 4: 30% Coinsurance up to $500; Tier 5: 30% Coinsurance up to $1,000 |

| Mail Order Drug | Tier 1: $0 Copayment; Tier 2: $25 Copayment; Tier 3: $180; Tier 4: 30% Coinsurance up to $1,500; Tier 5: 30% Coinsurance up to $1,000 |

| Inpatient Hospital | 25% Coinsurance after Plan Deductible is met |

| Emergency Room | 25% Coinsurance after Plan Deductible is met |

| Walk-in Urgent Care | $50 Copayment per visit at a Walk-In Center; $100 Copayment per visit at an Urgent Care Facility (Urgent Care Center) |

| Ambulance | 25% Coinsurance |

| Outpatient Surgery | $500 Copayment per visit at a Surgical Center; 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Laboratory Service | No Cost-Share at Site-of-Service Providers 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No Cost-Share at Site-of-Service Providers; 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Imaging | $75 Copayment per service up to an annual maximum of $375 for MRI, MRA, CAT, CTA, PET and SPECT scans at Site-of-Service Providers; 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Mental Health | 25% Coinsurance after Deductible is met |

| Durable Medical Equipment | 50% Coinsurance after Deductible is met |

| Individual Deductible | $5,500 |

| Family Deductible | $10,000 |

| Out-of-Pocket Maximum | $9,000 |

| Family Out-of-Pocket Maximum | $18,000 |

Anthem Silver Pathway CT PPO w/HSA

2024

| Benefit Year: | For Plan Year 2024 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $50 Copayment per visit after Plan Deductible is met |

| Specialist Office Visit | $100 Copayment per visit after Plan Deductible is met |

| Prescription Drugs | Tier 1: $0 Copay; Tier 2: $10 Copay; Tier 3: $60 Copay; Tier 4: 30% Coinsurance after Deductible is met; Tier 5: 30% Coinsurance after Deductible is met |

| Mail Order Drug | Tier 1: $0 Copay; Tier 2: $25 Copay; Tier 3: $180 Copay; Tier 4: 30% Coinsurance after Deductible is met; Tier 5: 30% after Deductible is met |

| Inpatient Hospital | 20% Coinsurance after Plan Deductible is met |

| Emergency Room | 20% Coinsurance after Plan Deductible is met |

| Walk-in Urgent Care | Walk-In: $40 Copayment per visit after Plan Deductible Urgent Care: $100 Copayment per visit after Plan Deductible |

| Ambulance | 20% Coinsurance after Plan Deductible is met |

| Outpatient Surgery | $400 Copayment per visit after Deductible is met at a Surgery Center; 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Laboratory Service | No Cost-Share after Deductible is met at Site-of-Service Providers 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | $75 Copayment per service after Deductible is met at Site-of-Service Providers; 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Imaging | $75 Copayment per service up to an annual maximum of $375 at Site-of-Service Providers; 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Mental Health | 20% Coinsurance after Deductible is met |

| Durable Medical Equipment | 50% Coinsurance after Deductible is met |

| Individual Deductible | $3,000 |

| Family Deductible | $6,000 |

| Out-of-Pocket Maximum | $7,000 |

| Family Out-of-Pocket Maximum | $14,000 |

Anthem Bronze Pathway CT PPO

2024

| Benefit Year: | For Plan Year 2024 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | No Cost after Plan Deductible is met |

| Specialist Office Visit | No Cost after Plan Deductible is met |

| Prescription Drugs | No Cost after Plan Deductible is met |

| Mail Order Drug | No Cost after Plan Deductible is met |

| Inpatient Hospital | No Cost after Plan Deductible is met |

| Emergency Room | No Cost after Plan Deductible is met |

| Walk-in Urgent Care | No Cost after Plan Deductible is met |

| Ambulance | No Cost after Plan Deductible is met |

| Outpatient Surgery | No Cost after Plan Deductible is met |

| Laboratory Service | No Cost-Share after Plan Deductible is met at an Independent Lab No Cost after Plan Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No Cost after Plan Deductible is met |

| Outpatient Diagnostic Imaging | No Cost after Plan Deductible is met |

| Outpatient Mental Health | No Cost after Plan Deductible is met |

| Durable Medical Equipment | No Cost after Plan Deductible is met |

| Individual Deductible | $9,000 |

| Family Deductible | $18,000 |

| Out-of-Pocket Maximum | $9,000 |

| Family Out-of-Pocket Maximum | $18,000 |

Anthem Bronze Pathway CT PPO w/HSA

2024

| Benefit Year: | For Plan Year 2024 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | No Cost after Plan Deductible is met |

| Specialist Office Visit | No Cost after Plan Deductible is met |

| Prescription Drugs | No Cost-Share after Deductible is met |

| Mail Order Drug | No Cost-Share after Deductible is met |

| Inpatient Hospital | No Cost after Plan Deductible is met |

| Emergency Room | No Cost after Plan Deductible is met |

| Walk-in Urgent Care | No Cost after Plan Deductible is met |

| Ambulance | No Cost after Plan Deductible is met |

| Outpatient Surgery | No Cost after Plan Deductible is met |

| Laboratory Service | No Cost-Share after Plan Deductible is met at an Independent Lab No Cost after Plan Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No Cost after Plan Deductible is met |

| Outpatient Diagnostic Imaging | No Cost after Plan Deductible is met |

| Outpatient Mental Health | No Cost after Plan Deductible is met |

| Durable Medical Equipment | No Cost after Plan Deductible is met |

| Individual Deductible | $7,450 |

| Family Deductible | $14,900 |

| Out-of-Pocket Maximum | $7,450 |

| Family Out-of-Pocket Maximum | $14,900 |

Anthem Gold Pathway CT PPO

2023

| Benefit Year: | For Plan Year 2023 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $25 Copayment per visit |

| Specialist Office Visit | $60 Copayment per visit |

| Prescription Drugs | Tier 1: No Cost; Tier 2: $10 Copay; Tier 3: $60 Copay; Tier 4: 30% up to $500; Tier 5: 30% up to $1000 |

| Mail Order Drug | Tier 1: No Cost; Tier 2: $25 Copay; Tier 3: $180 Copay; Tier 4: 30% up to $1500; Tier 5: 30% up to $1000 |

| Inpatient Hospital | No Cost after Plan Deductible is met |

| Emergency Room | 20% Coinsurance after Plan Deductible is met |

| Walk-in Urgent Care | $25 Copayment per visit at a Walk-In Center; $100 Copayment per visit at an Urgent Care Facility (Urgent Care Center) |

| Ambulance | No Cost |

| Outpatient Surgery | $300 Copayment per visit at a Surgical Center; No Cost-Share after Deductible is met at an Outpatient Hospital Facility |

| Laboratory Service | No Cost-Share at Site-of-Service Providers No Cost- Share after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No cost at site-of-service providers; No cost after deductible at outpatient hospital facility |

| Outpatient Diagnostic Imaging | $75 copay to $375 max at site-of-service providers; No cost after deductible is met at outpatient hospital facility |

| Outpatient Mental Health | No Cost-Share after deductible is met |

| Durable Medical Equipment | 50% Coinsurance after deductible is met |

| Individual Deductible | $2,500 |

| Family Deductible | $5,000 |

| Out-of-Pocket Maximum | $5,000 |

| Family Out-of-Pocket Maximum | $10,000 |

Anthem Silver Pathway CT PPO

2023

| Benefit Year: | For Plan Year 2023 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $50 Copayment per visit |

| Specialist Office Visit | $100 Copayment per visit |

| Prescription Drugs | Tier 1: $0 Copayment; Tier 2: $10 Copayment; Tier 3: $60 Copay; Tier 4: 30% Coinsurance up to $500; Tier 5: 30% Coinsurance up to $1,000 |

| Mail Order Drug | Tier 1: $0 Copayment; Tier 2: $25 Copayment; Tier 3: $180; Tier 4: 30% Coinsurance up to $1,500; Tier 5: 30% Coinsurance up to $1,000 |

| Inpatient Hospital | 25% Coinsurance after Plan Deductible is met |

| Emergency Room | 25% Coinsurance after Plan Deductible is met |

| Walk-in Urgent Care | $50 Copayment per visit at a Walk-In Center; $100 Copayment per visit at an Urgent Care Facility (Urgent Care Center) |

| Ambulance | 25% Coinsurance |

| Outpatient Surgery | $500 Copayment per visit at a Surgical Center; 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Laboratory Service | No Cost-Share at Site-of-Service Providers 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No Cost-Share at Site-of-Service Providers; 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Imaging | $75 Copayment per service up to an annual maximum of $375 for MRI, MRA, CAT, CTA, PET and SPECT scans at Site-of-Service Providers; 25% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Mental Health | 25% Coinsurance after Deductible is met |

| Durable Medical Equipment | 50% Coinsurance after Deductible is met |

| Individual Deductible | $5,500 |

| Family Deductible | $10,000 |

| Out-of-Pocket Maximum | $9,000 |

| Family Out-of-Pocket Maximum | $18,000 |

Anthem Silver Pathway CT PPO w/HSA

2023

| Benefit Year: | For Plan Year 2023 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $50 Copayment per visit after Plan Deductible is met |

| Specialist Office Visit | $100 Copayment per visit after Plan Deductible is met |

| Prescription Drugs | Tier 1: $0 Copay; Tier 2: $10 Copay; Tier 3: $60 Copay; Tier 4: 30% Coinsurance after Deductible is met; Tier 5: 30% Coinsurance after Deductible is met |

| Mail Order Drug | Tier 1: $0 Copay; Tier 2: $25 Copay; Tier 3: $180 Copay; Tier 4: 30% Coinsurance after Deductible is met; Tier 5: 30% after Deductible is met |

| Inpatient Hospital | 20% Coinsurance after Plan Deductible is met |

| Emergency Room | 20% Coinsurance after Plan Deductible is met |

| Walk-in Urgent Care | Walk-In: $40 Copayment per visit after Plan Deductible Urgent Care: $100 Copayment per visit after Plan Deductible |

| Ambulance | 20% Coinsurance after Plan Deductible is met |

| Outpatient Surgery | $400 Copayment per visit after Deductible is met at a Surgery Center; 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Laboratory Service | No Cost-Share after Deductible is met at Site-of-Service Providers 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | $75 Copayment per service after Deductible is met at Site-of-Service Providers; 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Imaging | $75 Copayment per service up to an annual maximum of $375 at Site-of-Service Providers; 20% Coinsurance after Deductible is met at an Outpatient Hospital Facility |

| Outpatient Mental Health | 20% Coinsurance after Deductible is met |

| Durable Medical Equipment | 50% Coinsurance after Deductible is met |

| Individual Deductible | $3,000 |

| Family Deductible | $6,000 |

| Out-of-Pocket Maximum | $7,000 |

| Family Out-of-Pocket Maximum | $14,000 |

Anthem Bronze Pathway CT PPO

2023

| Benefit Year: | For Plan Year 2023 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | No Cost after Plan Deductible is met |

| Specialist Office Visit | No Cost after Plan Deductible is met |

| Prescription Drugs | No Cost after Plan Deductible is met |

| Mail Order Drug | No Cost after Plan Deductible is met |

| Inpatient Hospital | No Cost after Plan Deductible is met |

| Emergency Room | No Cost after Plan Deductible is met |

| Walk-in Urgent Care | No Cost after Plan Deductible is met |

| Ambulance | No Cost after Plan Deductible is met |

| Outpatient Surgery | No Cost after Plan Deductible is met |

| Laboratory Service | No Cost-Share after Plan Deductible is met at an Independent Lab No Cost after Plan Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No Cost after Plan Deductible is met |

| Outpatient Diagnostic Imaging | No Cost after Plan Deductible is met |

| Outpatient Mental Health | No Cost after Plan Deductible is met |

| Durable Medical Equipment | No Cost after Plan Deductible is met |

| Individual Deductible | $9,000 |

| Family Deductible | $18,000 |

| Out-of-Pocket Maximum | $9,000 |

| Family Out-of-Pocket Maximum | $18,000 |

Anthem Bronze Pathway CT PPO w/HSA

2023

| Benefit Year: | For Plan Year 2023 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | No Cost after Plan Deductible is met |

| Specialist Office Visit | No Cost after Plan Deductible is met |

| Prescription Drugs | No Cost-Share after Deductible is met |

| Mail Order Drug | No Cost-Share after Deductible is met |

| Inpatient Hospital | No Cost after Plan Deductible is met |

| Emergency Room | No Cost after Plan Deductible is met |

| Walk-in Urgent Care | No Cost after Plan Deductible is met |

| Ambulance | No Cost after Plan Deductible is met |

| Outpatient Surgery | No Cost after Plan Deductible is met |

| Laboratory Service | No Cost-Share after Plan Deductible is met at an Independent Lab No Cost after Plan Deductible is met at an Outpatient Hospital Facility |

| Outpatient Diagnostic Tests | No Cost after Plan Deductible is met |

| Outpatient Diagnostic Imaging | No Cost after Plan Deductible is met |

| Outpatient Mental Health | No Cost after Plan Deductible is met |

| Durable Medical Equipment | No Cost after Plan Deductible is met |

| Individual Deductible | $7,450 |

| Family Deductible | $14,900 |

| Out-of-Pocket Maximum | $7,450 |

| Family Out-of-Pocket Maximum | $14,900 |

ConnectiCare Passage Gold POS PCP – For Renewal Only

2023

| Benefit Year: | For Plan Year 2023 |

| Referrals: | Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $30 Copayment per visit |

| Specialist Office Visit | $50 Copayment per visit |

| Prescription Drugs | Tier 1: $10 Copayment; Tier 2: $50 Copayment; Tier 3: 50% up to $250; Tier 4: 50% up to $500 |

| Mail Order Drug | Tier 1: $20 Copayment; Tier 2: $100 Copayment; Tier 3: 50% up to $500 |

| Inpatient Hospital | 20% Coinsurance per admission after INET Plan Deductible is met |

| Emergency Room | 20% Coinsurance per visit after INET Plan Deductible is met |

| Walk-in Urgent Care | $100 Copayment per visit |

| Ambulance | 20% Coinsurance after INET Plan Deductible is met |

| Outpatient Surgery | $500 copayment per visit at an Ambulatory Surgery Center; 20% coinsurance after INET plan deductible is met at an Outpatient Hospital Facility |

| Laboratory Service | Laboratory: $10 copayment |

| Outpatient Diagnostic Tests | $50 copayment per service at freestanding facility; 20% coinsurance per service after INET plan deductible is met at Hospital Facility |

| Outpatient Diagnostic Imaging | $75 copayment per service up to five copayments per year at a Freestanding Facility, then copayment waived; 20% coinsurance per service after INET plan deductible is met at a Hospital Facility |

| Outpatient Mental Health | $50 Copayment per visit |

| Durable Medical Equipment | 50% Coinsurance per equipment/supply |

| Individual Deductible | $3,000 |

| Family Deductible | $6,000 |

| Out-of-Pocket Maximum | $8,500 |

| Family Out-of-Pocket Maximum | $17,000 |

ConnectiCare Choice Silver POS – For Renewal Only

2023

| Benefit Year: | For Plan Year 2023 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $50 Copayment per visit |

| Specialist Office Visit | $75 Copayment per visit |

| Prescription Drugs | Tier 1: $20 copayment; Tier 2: $60 copayment; Tier 3: 50% coinsurance up to $300; Tier 4: 50% coinsurance up to $500 |

| Mail Order Drug | Tier 1: $40 copayment; Tier 2: $120 copayment; Tier 3: 50% coinsurance up to $600 |

| Inpatient Hospital | 40% Coinsurance per admission after INET Plan Deductible is met |

| Emergency Room | 40% Coinsurance after per visit INET Plan Deductible is met |

| Walk-in Urgent Care | $100 Copayment per visit |

| Ambulance | 40% Coinsurance per service after INET Plan Deductible is met |

| Outpatient Surgery | 40% Coinsurance per visit after INET Plan Deductible is met |

| Laboratory Service | 40% Coinsurance per service after INET plan deductible is met |

| Outpatient Diagnostic Tests | 40% Coinsurance per service after INET Plan Deductible is met |

| Outpatient Diagnostic Imaging | 40% Coinsurance per service after INET Plan Deductible is met |

| Outpatient Mental Health | $75 Copayment per visit |

| Durable Medical Equipment | 40% Coinsurance per equipment/supply after INET Plan Deductible is met |

| Individual Deductible | $4,000 |

| Family Deductible | $8,000 |

| Out-of-Pocket Maximum | $9,100 |

| Family Out-of-Pocket Maximum | $18,200 |

ConnectiCare Choice Silver POS w/HSA – For Renewal Only

2023

| Benefit Year: | For Plan Year 2023 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | 25% Coinsurance after Plan Deductible is met |

| Specialist Office Visit | 25% Coinsurance after Plan Deductible is met |

| Prescription Drugs | Deductible then, Tier 1: $10 Copayment; Tier 2: $60 Copayment; Tier 3: 50% up to $300; Tier 4: 50% up to $500 |

| Mail Order Drug | Deductible then, Tier 1: $20 Copayment; Tier 2: $120 Copayment; Tier 3: 50% up to $600; Tier 4: N/A |

| Inpatient Hospital | 25% Coinsurance after Plan Deductible is met |

| Emergency Room | 25% Coinsurance after Plan Deductible is met |

| Walk-in Urgent Care | 25% Coinsurance after Plan Deductible is met |

| Ambulance | 25% Coinsurance after Plan Deductible is met |

| Outpatient Surgery | 25% Coinsurance after Plan Deductible is met |

| Laboratory Service | 25% Coinsurance after Plan Deductible is met |

| Outpatient Diagnostic Tests | 25% Coinsurance after Plan Deductible is met |

| Outpatient Diagnostic Imaging | 25% Coinsurance after Plan Deductible is met |

| Outpatient Mental Health | 25% Coinsurance after Plan Deductible is met |

| Durable Medical Equipment | 25% Coinsurance after Plan Deductible is met |

| Individual Deductible | $3,500 |

| Family Deductible | $7,000 |

| Out-of-Pocket Maximum | $6,900 |

| Family Out-of-Pocket Maximum | $13,800 |

ConnectiCare Choice Bronze POS – For Renewal Only

2023

| Benefit Year: | For Plan Year 2023 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | $45 Copayment per visit |

| Specialist Office Visit | $60 Copayment per visit |

| Prescription Drugs | Tier 1: $20 copayment; Tier 2: $60 copayment; Tier 3: 50% coinsurance up to $300; Tier 4: 50% coinsurance up to $500 |

| Mail Order Drug | Tier 1: $40 copayment; Tier 2: $120 copayment; Tier 3: 50% coinsurance up to $600 |

| Inpatient Hospital | 40% coinsurance after INET Plan Deductible is met |

| Emergency Room | 40% coinsurance after INET Plan Deductible is met |

| Walk-in Urgent Care | $100 Copayment per visit after INET Plan Deductible is met |

| Ambulance | 40% coinsurance after INET Plan Deductible is met |

| Outpatient Surgery | $500 copay per visit after INET plan deductible is met at an Ambulatory Surgery Center; 40% coinsurance per visit after INET plan deductible is met at an Outpatient Hospital Facility |

| Laboratory Service | $20 Copayment after INET Plan Deductible is met |

| Outpatient Diagnostic Tests | $50 copayment per service after INET plan deductible is met at Freestanding Facility; 40% coinsurance per service after INET plan deductible is met at a Hospital Facility |

| Outpatient Diagnostic Imaging | $75 copayment per service after INET plan deductible is met up to five copayments per year at a Freestanding Facility, then copayment waived; 40% coinsurance per service after INET plan deductible is met at a Hospital Facility |

| Outpatient Mental Health | 40% coinsurance per visit after INET plan deductible is met |

| Durable Medical Equipment | 40% Coinsurance after INET plan deductible is met |

| Individual Deductible | $7,500 |

| Family Deductible | $15,000 |

| Out-of-Pocket Maximum | $9,100 |

| Family Out-of-Pocket Maximum | $18,200 |

ConnectiCare Choice Bronze POS w/HSA – For Renewal Only

2023

| Benefit Year: | For Plan Year 2023 |

| Referrals: | Not Required |

| Preventative Adult Exams: | No Cost |

| PCP Office Visit: | 40% Coinsurance after INET plan deductible is met |

| Specialist Office Visit | 50% Coinsurance after INET Plan Deductible is met |

| Prescription Drugs | Tier 1: $20 copayment; Tier 2: $60 copayment; Tier 3: 50% coinsurance up to $300; Tier 4: 50% coinsurance up to $500 |

| Mail Order Drug | Tier 1: $40 copayment; Tier 2: $120 copayment; Tier 3: 50% coinsurance up to $600 |

| Inpatient Hospital | 50% Coinsurance after INET Plan Deductible is met |

| Emergency Room | 50% Coinsurance after INET Plan Deductible is met |

| Walk-in Urgent Care | 50% Coinsurance after INET Plan Deductible is met |

| Ambulance | 50% Coinsurance after INET Plan Deductible is met |

| Outpatient Surgery | 50% Coinsurance after INET Plan Deductible is met |

| Laboratory Service | 50% Coinsurance after INET Plan Deductible is met |

| Outpatient Diagnostic Tests | 50% Coinsurance after INET Plan Deductible is met |

| Outpatient Diagnostic Imaging | 50% Coinsurance after INET Plan Deductible is met |

| Outpatient Mental Health | 50% Coinsurance after INET Plan Deductible is met |

| Durable Medical Equipment | 50% Coinsurance after INET Plan Deductible is met |

| Individual Deductible | $6,000 |

| Family Deductible | $12,000 |

| Out-of-Pocket Maximum | $7,500 |

| Family Out-of-Pocket Maximum | $15,000 |

Anthem Plans

Review your plan documents, prescription drug formularies and provider directory online for the most up to date information at anthem.com

Deductible is waved for drugs on the preventive Rx drug list

All Access Health CT Small Business Plans have embedded deductibles

Outside of Connecticut coverage – PPO plans have full BlueCard access using the BlueCard PPO network. HMO plans have limited BlueCard access for urgent and emergency coverage only using the Participating Provider Network

All discount programs for small groups apply for on-and off-exchange members

Curious about individual plan options for you or your employees?

While we focus on small businesses with 50 employees or less, you can enroll in the individual marketplace as sole proprietors.

Understanding your options should be simple.

It is important to us that you are confident about your options and the help we can provide. We have answered the most common questions below and can offer 1-on-1 help, as well.

“Can employees who live outside of Connecticut be covered?”

No. Access Health CT Small Business group health plans and individual health plans do not offer out-of-state coverage. Employers and employees should review each plan’s payment policies regarding out-of-network care.

Kayla Henderson | Contact me

Kayla Henderson | Contact me

“Who is eligible for ICHRA?”

• Any employer can offer ICHRA.

• Employees must have individual health insurance coverage (not through a spouse or employer-provided group plan).

• ICHRA plans must be offered to specific employee classes with no overlap (e.g., full-time, part-time, seasonal, etc.).

Franco Barrero | Contact me

Franco Barrero | Contact me

Interested in learning more about health insurance for small businesses?

As insurance industry and government requirements change, our articles, videos and podcast series can help explain what that means for you and the coverage you offer.

Download PDF

Download PDF